Exploring Supplement Trends for 2026: What’s Growing, What’s Changing, and What Brands Should Watch

2026 is shaping up to be a high-velocity year for supplement innovation—driven by two realities happening at the same time: consumers are demanding more targeted outcomes (focus, sleep, gut, longevity, hydration), while retailers and marketplaces are raising the bar on quality, substantiation, and compliance.

Industry forecasts continue to point to strong long-term growth. One commonly cited estimate values the global dietary supplements market at $192.65B in 2024 with projections reaching $327.42B by 2030 (a reported ~9.1% CAGR).1 While forecasts vary by methodology, the directional takeaway is consistent: demand is broadening, and “commodity supplements” are increasingly being replaced by benefit-led, format-forward products.

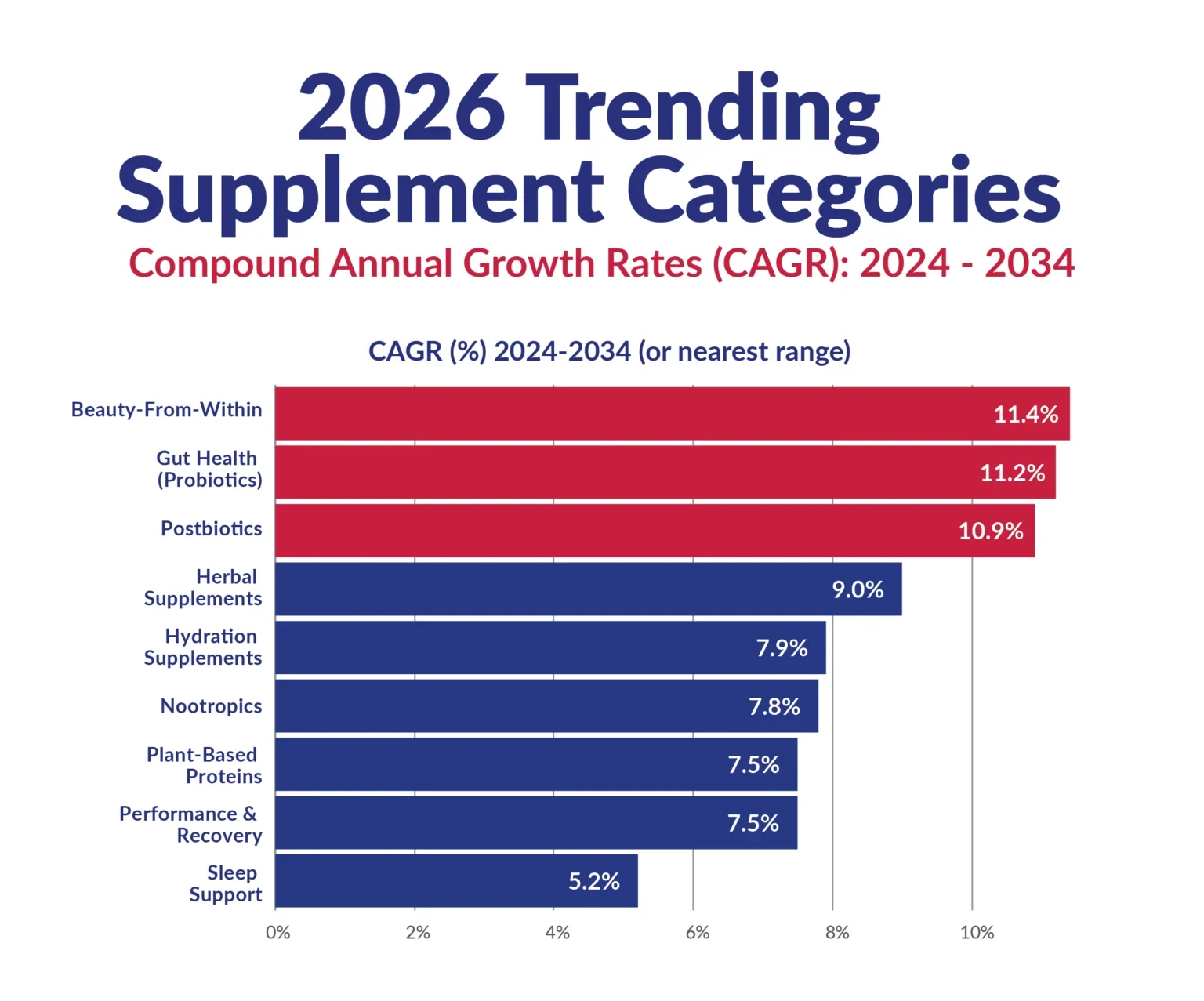

Category momentum heading into 2026

U.S. ingredient category share is often described as led by vitamins and specialty ingredients, followed by herbs/botanicals, sports nutrition, meal replacements, and minerals.2 What’s especially useful for brand builders is where growth is clustering:

- Performance & recovery (sports nutrition), including creatine and nitric-oxide-support ingredients (e.g., beetroot, citrulline), continues to expand as fitness becomes mainstream.

- Specialty ingredients (collagen, fiber, pre/pro/synbiotics) are growing as consumers connect digestion + skin + metabolic health.

- Herbs & botanicals keep gaining share as shoppers seek “natural” solutions for stress, mood, and sleep.

- Nootropics & brain health remain a magnet category (adaptogens + functional mushrooms + focus blends), propelled by work, study, and screen-heavy lifestyles.

- Hydration + electrolyte products are crossing over from sports into everyday wellness, beauty-from-within, and travel.

- Women’s health (menopause, urinary health, fertility, hormonal balance) continues to mature into a core shelf, not a niche.

For brands planning launches or refreshes, the “2026 edge” often comes from pairing trend-aligned benefits with modern delivery formats. In practice, that means building products people can actually stick with: gummies for daily routines, tinctures for flexible dosing, and functional drinks for lifestyle-driven usage occasions.

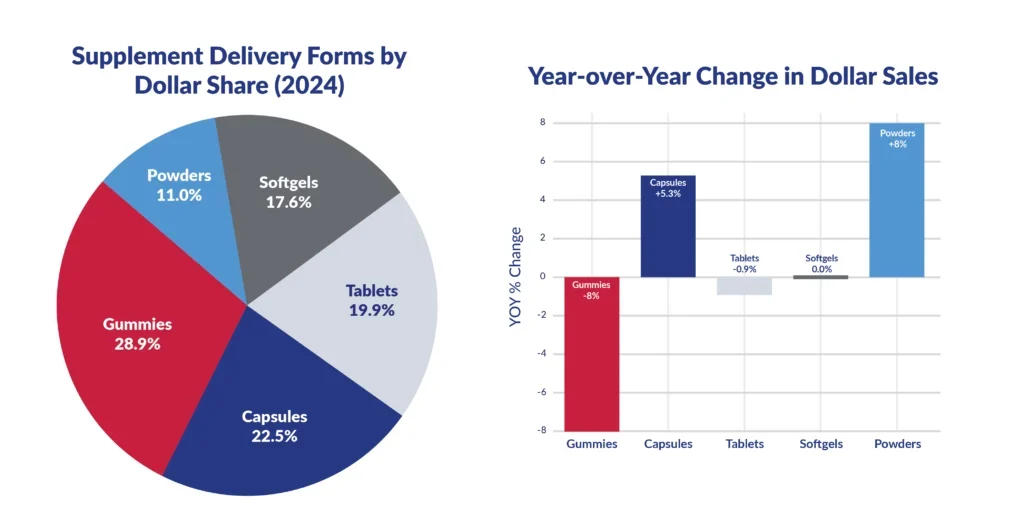

Format Trends: Why Delivery Form Is Becoming the Product

Even when two formulas use similar ingredients, the format often determines who buys, how consistently they use it, and what they’re willing to pay. Recent retail tracking frequently highlights gummies as a major share-holder in supplements, while powders and capsules show growth strength in some datasets.3 The practical implication for 2026: brands are increasingly winning by matching format to consumer intent.

Where gummies, tinctures, and drinks fit best

- Gummies shine for daily compliance and routine stacking (sleep, beauty, gut, minerals, cognitive). They’re especially effective when brands differentiate with clinically studied ingredients, clean-label positioning, and clear claims discipline.

- Tinctures are ideal for flexible dosing, premium positioning, and “fast routine” shoppers who want control over serving size—especially in minerals (like magnesium), stress blends, and sleep support.

- Functional drinks are expanding from sports hydration into mood, focus, beauty hydration, and “better-for-you” daily wellness. They’re also one of the strongest formats for brands built around lifestyle communities and repeat purchase behavior.

Ingredient themes that map cleanly to 2026 demand

Many of the fastest-rising product concepts share a common thread: they’re framed around everyday performance (mental or physical) and daily systems (gut, sleep, metabolic, longevity) rather than one-off fixes. Examples commonly highlighted in trend coverage include:

- Plant-based proteins (e.g., pea + rice) for digestibility, sustainability, and allergen-friendly positioning.4

- Nootropics (adaptogens, botanicals, functional mushrooms) for focus, memory, stress resilience.5

- Gut health (pre/pro/postbiotics, fibers) as a foundation category connected to immunity, mood, and metabolic outcomes.6

- Longevity (cellular + mitochondrial narratives) as a mainstream story, not just “anti-aging.”

- Hydration (electrolytes + beauty hydration) blending performance + appearance priorities.

Quality expectations are rising alongside trend demand

2026 product planning isn’t only about what’s popular—it’s also about what’s allowed, verifiable, and defensible. As large marketplaces continue to emphasize cGMP documentation and third-party verification, brands that build quality-forward from day one can reduce friction later.

If you sell (or plan to sell) on major marketplaces, this update is worth reading: Amazon Expands cGMP Verification Requirements for Dietary Supplements

And on the formulation side, ingredient synergy is becoming a major part of the “why it works” story—especially in minerals and foundational nutrients: Why Vitamin D Doesn’t Work the Same for Everyone

What This Means for Product Strategy and Compliance

As regulatory scrutiny and marketplace standards continue to evolve, ingredient transparency and formulation logic matter more than ever. Research-backed combinations—like magnesium supporting vitamin D balance—help brands align with consumer expectations for effectiveness without overstated claims.

This is particularly relevant as platforms like Amazon introduce tighter compliance requirements around manufacturing practices and verification. Brands developing mineral-based or functional supplements should ensure their formulations are supported by sound science and produced under current Good Manufacturing Practices (cGMP).

These regulatory shifts are outlined in Amazon Expands cGMP Verification Requirements for Dietary Supplements , which details what supplement sellers should prepare for moving forward.

Taken together, the emerging science around magnesium and vitamin D underscores a broader trend: consumers and platforms alike are rewarding products that are thoughtfully formulated, responsibly manufactured, and supported by credible research.

As brands explore opportunities in mineral, cognitive, and functional wellness categories, magnesium gummies and tinctures represent adaptable, scalable formats that fit well within today’s compliance and consumer landscape—while addressing a quietly critical nutritional gap.